When should I register as an employer with HMRC?

You should register as an employer with HM Revenue and Customs(HRMC) when you start employing staff. The registration must be done before your first payday. Please note that it can take up to 5 working days(or longer) to get your employer PAYE reference number. However, you can't register with HMRC two months before you start paying your staff.

Must I wait till the start of a new tax year before switching my payroll provider?

No, you can switch your payroll provider at any time in the tax year. However, April is an ideal time as it isthe beginning of the financial tax year. When you transfer your payroll to JK Bookkeeping Ltd, we'll carry over all your cumulative and year-to-date payroll figures from your current payroll company.

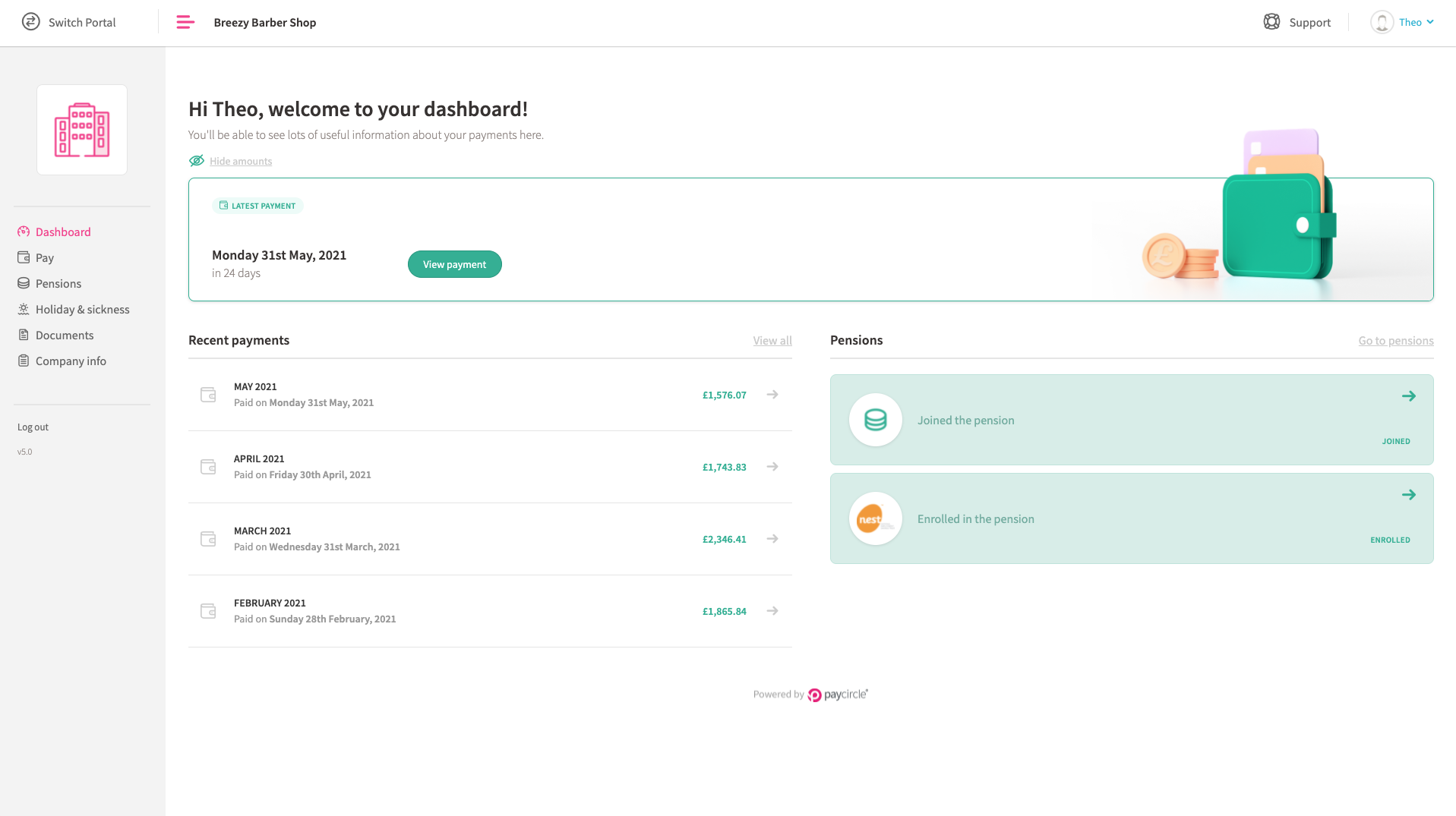

Do you deal with Pension Automatic Enrolment?

Pension Automatic Enrolment has proved a challenge for many businesses big and small, but at JK Bookkeeping, we do everything possible to assist you and make it stress-free as possible. We accompany you through the Pension Automatic Enrolment journey, no matter whether you are facing your staging date, or if you are already a few years into the process.

Can I make changes to my payroll information after you have processed it?

Hopefully, this situation may not arise as our team will always send you the final payroll for approval before submitting it. If the situation thus arise and there is a need to change any information after we have processed your payroll, we'll have to re-run it again and charge you for the additional work.

What is RTI?

RTI means Real Time Information. It is the new way of reporting wages, salaries, PAYE and National Insurance to HMRC. All employers are now expected to file a report to HMRC every time they pay their employees.

If I am a company director or secretary do I still need to register as an employer?

Yes. Directors who are involved in the day-t-day operations of a limited company are seen as employees of that company as well as employers. If paid in the normal manner (wages, salary) then you will need to register as an employer with HMRC and set up a PAYE scheme.